Bootstrapping Zero Coupon

Book a demo Try it for free. The bootstrap method that this function uses.

Bootstrapping Spot Rates Cfa Frm And Actuarial Exams Study Notes

Shop at over 3500 Stores and Save.

. A zero curve consists of the yields to maturity for a portfolio of theoretical zero-coupon bonds that are derived from the input Bonds portfolio. Julian in water sports was such a great and interesting captain of our snorkel trip Shane in grounds keeping was a joy every morning. Ad Find the best Discounts coupon promo codes and deals for August 2022.

Bootstrapping is a method for constructing a zero-coupon yield curve from the prices of a set of coupon-bearing productsAs you may know Treasury bills offered by the. Ad Browse Business Supplies Services Coupons Deals While Earning Instant Rewards. Here you will learn about creating a zero coupon curve by bootstrapping across a range of interest rate maturities.

An individual is said to be. Get the best deal with our latest coupon codes. Solve this equation in order to obtain r 05.

Small business and startups. Bootstrapping zero coupon swap curve. We see how to adjust for semi-annual.

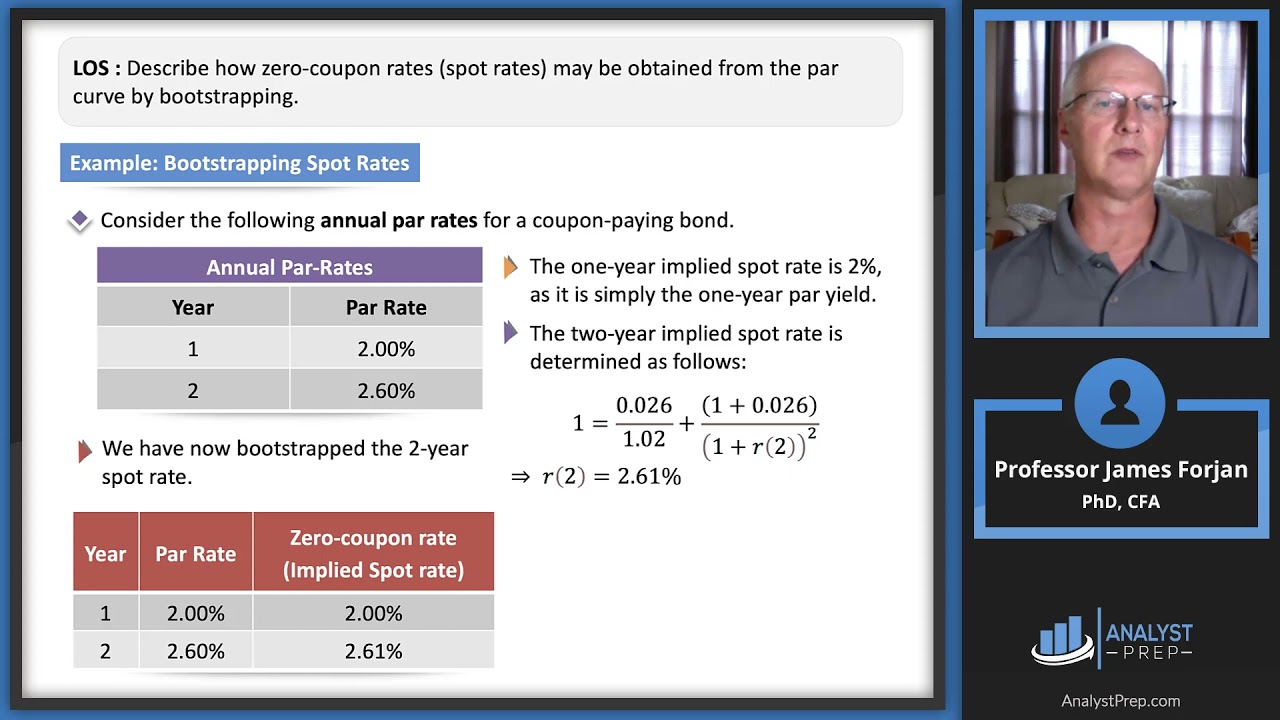

That was the complete bootstrapping process of deriving a zero coupon yield curve from the swap curve. Bootstrapping How to Construct a Zero Coupon Yield. Bootstrapping spot rates is a forward substitution method that allows investors to determine zero-coupon rates using the par yield curve.

I have daily data for maturities 3M 1Y 2Y 5Y 7Y 10Y from. The bootstrapping method. My old monitor is 16x10 format which gives more vertical pixels and I like that for web browsing but Dell doesnt have many of those.

We can use the yield curve to value an interest rate swap. To overcome these problems one constructs a zero-coupon yield curve from the prices of these traded instruments. I understand the basic logic of bootstrapping zero coupon rates take a bond discount each cashflow at the prevailingpreviously solved zero rate and solve for the last rate.

Bootstrapping describes a situation in which an entrepreneur starts a company with little capital relying on money other than outside investments. The slightly difficult part is to bootstrap zero rates from market swap rates for IRS. You can then obtain your zero rates step-by-step.

Get The Free Capital One Shopping Extension To Save On Business Supplies Services. F222045e-0163 - 4166294e-0013803735e001 One year zero0525826. The par curve shows the yields to.

To reiterate the spot curve is made up of spot interest rates for zero coupon bonds of different maturities. Look at the first equation you know S 05 from your swap curve. Coupon bootstrapping excel zero rates.

In this step we will apply the bootstrapping method to calculate the spot rates. Ad Weve Paid Our Members Over 2 Billion in Cash Back. A zero coupon swap is an exchange of income streams in which the stream of floating interest-rate payments is made periodically as it would be in a.

Ad Browse Business Supplies Services Coupons Deals While Earning Instant Rewards. Join over 15 Million Members Earning Cash Back. La technique utilisée pour y.

Bootstrapping spot rates or zero coupon interest rates works as follows. With this value go. Afin de pallier à ces problèmes on construit à partir des prix dinstruments cotés une courbe de taux zéro-coupon.

Get The Free Capital One Shopping Extension To Save On Business Supplies Services. Zero Coupon Swap. Could not bootstrap the 3rd instrument maturity November 19th 2 009.

As a reminder the zero. Shop at Over 3500 Stores Get Paid. CODES 7 days ago Bootstrapping is a method to construct a zero-coupon yield curve Yield Curve A yield curve is a plot of bond yields.

La méthode du bootstrapping. Deposit and futures have one bullet payment at maturity but IRS has in-between cash flows. Im trying to bootstrap the US swap curve into a zero coupon curve see Bloomberg screenshot.

Suppose we are given two par rates the par rate for one year 100 and the par rate.

What Is Bootstrapping Learn The Cfa Level I Concept

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

Estimating The Zero Coupon Rate Or Zero Rates Using The Bootstrap Approach And With Excel Linest Youtube

No comments for "Bootstrapping Zero Coupon"

Post a Comment